Remodeling your home is a big financial leap – get it right, and you’ve got a space you adore without breaking the bank; get it wrong, and you’re staring at a depleted savings account and a half-finished kitchen. Smart budgeting isn’t about pinching every penny – it’s about knowing where to splurge for lasting value and where to save without sacrificing quality. This article dives into the art of balancing your remodel budget, helping you allocate funds wisely, avoid the 53% overrun trap (per Houzz data), and come out with a project you’re proud of – not panicked over.

The Importance of a Remodeling Budget

A remodel without a budget is like a road trip without a map— – might end up somewhere cool, but you’re just as likely to run out of gas in the middle of nowhere. A well-defined budget gives you control, setting boundaries so you don’t blow $5,000 on a whim – like that imported Italian tile you saw on Instagram – while skimping on essentials like plumbing that could cost $3,000 to fix later. Without it, you risk overspending (hello, credit card debt), compromising quality (cheap fixtures that leak in six months), or letting scope creep turn a $20,000 bathroom into a $30,000 money pit. Houzz’s 2023 study found 53% of homeowners exceed their renovation budgets – join them. A smart budget lets you prioritize (new windows over a fancy chandelier), make trade-offs (stock cabinets vs. custom), track spending, and tell your contractor, “Here’s the line—stick to it.”

Creating Your Remodeling Budget

With both free and professional-grade remodel budgeting tools out there – you have no excuse for not taking control of costs – before costs take control of you.

Step one: figure out your total spend. Assess your finances – how much cash do you have, and are you dipping into savings or borrowing? A $25,000 remodel might mean $20,000 from savings and a $5,000 loan at 5% – that’s $263/month for two years, doable for some, not all.

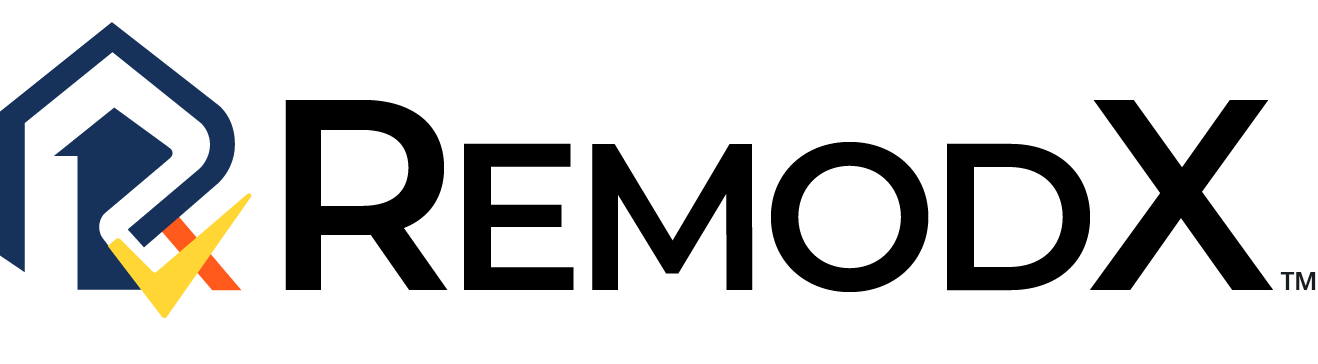

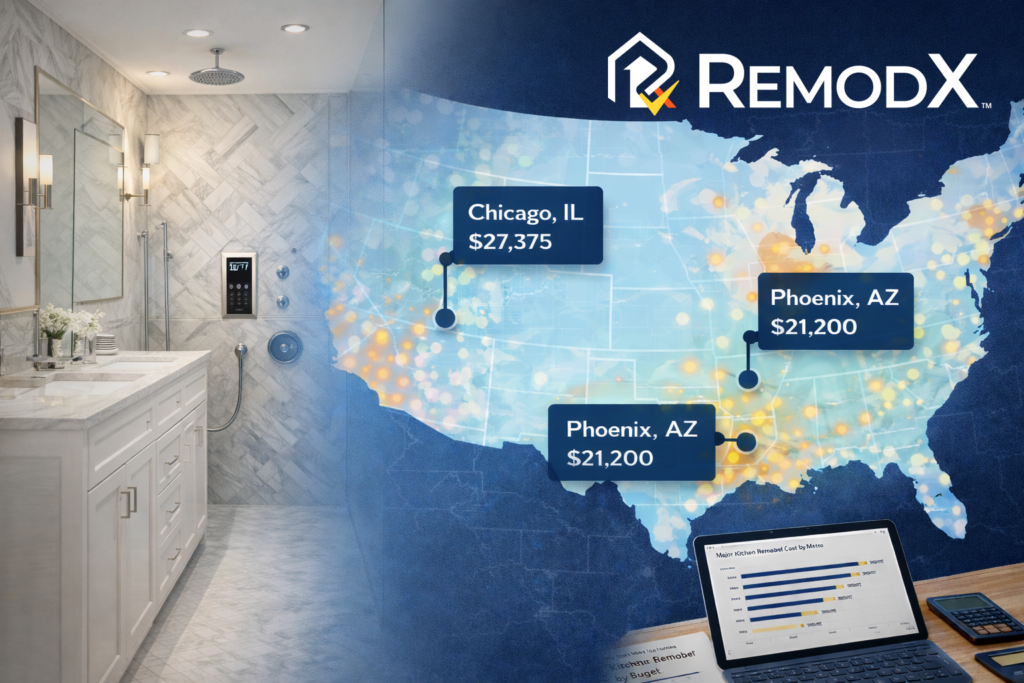

Add a contingency of 10-20%, or $2,500-$5,000 on $25,000 – for the inevitable surprises, like a rotted joist costing $1,500 to replace. Next, break it down: labor’s 40–50% ($10,000–$12,500), materials 30-40% ($7,500–$10,000), permits 5-10% ($1,250–$2,500), and that contingency. Prioritize essentials—structural fixes over decor – and stay flexible; if lumber spikes 15%, shift funds from “nice-to-haves.” Research costs—HomeAdvisor says a mid-range kitchen remodel averages $26,000 nationally, but your area might be $20,000 or $35,000 – get local quotes.

Where to Splurge

- Structural Elements: Foundations, framing, roofing—skimp here, and you’re fixing cracks in five years. A solid roof at $8,000 beats a $4,000 leaky one needing $5,000 repairs later—safety and durability aren’t negotiable.

- Core Systems: HVAC, plumbing, electrical—high-efficiency units save cash long-term. A $3,000 furnace with 95% efficiency cuts heating bills by $200/year over a $1,500 clunker—plus, no mid-winter breakdowns.

- High-Use Areas: Kitchens and bathrooms take a beating—splurge on durable surfaces. Quartz counters at $4,000 outlast $1,500 laminate, dodging stains and chips that scream “cheap” at resale.

- Timeless Design: Classic styles—white subway tile, neutral paint—stay fresh, saving $5,000 redo’s when trends fade. That neon accent wall? Fun now, dated in three years.

Where to Save

- Cosmetic Elements: Paint, hardware, lighting—$200 paint vs. $800 pro job, same vibe. Swap a $50 knob for a $10 one – easy to upgrade later.

- Stock Items: Cabinets, vanities, doors – stock at $2,000 beats $5,000 custom, and they’re ready now, not in eight weeks.

- DIY Projects: Painting, demo, landscaping – $500 saved on a weekend’s sweat. Demo’s $1,000 pro vs. $100 in dumpster fees – grab a sledgehammer if you’re game.

- Sales and Discounts: Hit Home Depot’s spring sale – tile drops from $5 to $3 per square foot, saving $400 on a 200-square-foot floor.

Strategies for Staying on Budget

- Get Detailed Bids: Vague quotes hide $2,000 surprises – demand line items: $5,000 labor, $3,000 materials, $500 permits.

- Avoid Change Orders: Mid-job “let’s add a window” adds $1,500 – stick to your scope.

- Track Expenses: Log every dime—$200 paint, $1,000 tile—in a spreadsheet or app.

- Communicate: Tell your contractor, “$25,000 max – flag me at $20,000” – no surprises.

The Importance of a Contingency Fund

Surprises aren’t “if”—they’re “when.” Hidden rot ($1,000), code upgrades ($2,000), lumber jumping 20% ($1,500) – a 10–20% contingency ($2,500–$5,000 on $25,000) covers it. Without it, you’re cutting corners – cheap tile that cracks – or borrowing at 8% interest, adding $400 in payments. It’s not extra – it’s survival.

Seeking Professional Guidance

Overwhelmed? A remodel consultant can save your bacon – $500 upfront beats $5,000 in mistakes. They’ll tell you quartz is worth it but custom trim isn’t, and they’ll catch that $2,000 electrical upgrade you missed.

Conclusion: Investing Wisely

Smart budgeting turns a remodel into an investment, not a gamble. With a solid plan, $25,000 can get you a kitchen that lasts 20 years, not a $35,000 regret. Track it, stick to it, and you’ll love the result – without the financial hangover.